Reverse mortgages are commonly mistaken for charging a lot of upfront costs. In reality, the CHIP Reverse Mortgage has many of the same costs as a regular mortgage in Canada.

Interest Rates

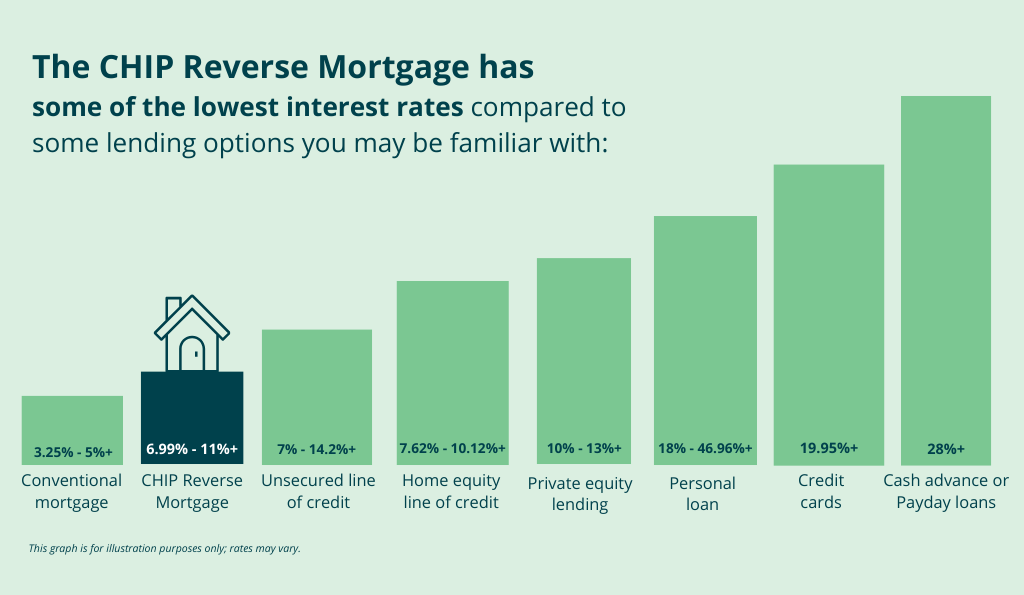

Reverse mortgage interest rates are posted and updated regularly, similar to the bigger banks. And while they may be a little higher than that of a traditional mortgage or line of credit (approximately 2% higher), the CHIP Reverse Mortgage provides homeowners with tax-free cash upfront without the need for any regular mortgage payments until the homeowners or their heirs sell their home, a feature that none of the other financial solutions provide. In addition, some of the other options available such as credit cards and private lending options often have significantly higher interest rates in comparison to a reverse mortgage. Alternatively, some Canadians may have trouble qualifying for a line of credit through a financial institution.

Table 1 Interest Rates are in line with industry standards

Reverse Mortgage Fees

Reverse mortgage fees are similar to those associated with a regular mortgage and include an appraisal fee, legal fees and an administrative fee.

Appraisal Fee

This fee is paid to an external property appraiser and can range from approximately $300-600. With a regular mortgage, there is also an appraisal fee that the lender orders on the borrower’s behalf (most home appraisals for a regular mortgage also range from $300-600).

Why do you need to get a home appraisal?

The current fair market value of your home is a factor in determining how much money you can get from a reverse mortgage; therefore, an appraisal is a requirement to get the application started. Once the appraisal is complete, the appraiser will inform us of the current fair market value of your home and we can then determine the amount you are eligible to receive.

A regular mortgage also requires a home appraisal for a few different reasons:

- Lenders want a reasonable idea of the value of a property in the current market before they are willing to lend against the home.

- Appraisals are sometimes done when an owner needs mortgage insurance, as it is required by the Department of Finance and mortgage insurance companies such as CMHC.

Fee for independent legal advice

This fee, approximately $300-700 is paid to a lawyer of your choice, or if preferred, legal representation can be arranged. With a regular mortgage, there are also legal fees paid to a real estate lawyer upon closing. This fee can typically be $500-1000 (plus GST/HST).

Why do you need to consult with a lawyer?

The CHIP Reverse Mortgage requires that every homeowner applying for a reverse mortgage seek independent legal advice for their benefit and protection. With a regular mortgage, borrowers are encouraged to hire a real estate lawyer to help arrange a registration of property.

Standard closing and administrative costs

This is the only fee that is paid to HomeEquity Bank. This fee is typically financed with the proceeds of the reverse mortgage. If you’re interested to know more about our current reverse mortgage rates and fees click here. With a regular mortgage, there are a couple mandatory closing costs that the borrower is responsible for. This includes:

-

Land Transfer Tax:

This is calculated as a percentage of the purchase price of the home. All provinces in Canada have a Land Transfer Tax (LTT) varying in each province and is payable on closing. Some cities, such as Toronto, even have a municipal LTT. To find out the land transfer tax in your province, please visit your local government website on land transfer taxes. This article from RENX.ca also does a good job at explaining the land transfer taxes in Alberta, B.C., Ontario and Quebec.https://renx.ca/calculating-land-transfer-taxes-across-canada/

-

Title Insurance:

Most lenders in Canada require title insurance to protect against losses in the event of a property ownership dispute. This is purchased through your real estate lawyer and can cost approximately $100-300.

-

Home Inspection Cost:

A home inspection may be conducted for a buyer to ensure that the home does not have any hidden costs due to underlying issues. For a seller, a home inspection can be conducted to help facilitate the sale of the home. The approximate cost of a home inspection in Canada is approximately $200-400 depending on the size of the home.

One of the most common misconception of reverse mortgages in Canada is the fees associated with the product. As you can see, the fees are very similar to those of a regular mortgage and the costs are similar to the fees of a mortgage in Canada.

The CHIP Reverse Mortgage is a great financial solution for many Senior Canadians and can help supplement retirement finances. The senior population continues to rise each year (the number of Canadians aged 65+ is expected to be 9.7 million, 22.6% of the total Canadian population by 2041). Partly due to increased life expectancy, many older Canadians are cash strapped but they are not saving enough to prepare for their retirement. A CHIP Reverse Mortgage enables them to access their home equity in tax-free cash so that they can live their retirement financially stress-free and actually enjoy their later years in their memory-filled homes. Find out how the CHIP Reverse Mortgage® can help boost your retirement income by calling us at 1-866-522-2447 or get your free reverse mortgage estimate now.