Everyone has a personal vision of what a happy retirement means. To some, it may mean a laidback lifestyle, spending most of their time with children or grandchildren. To others, it may mean leisure travel or other unique adventures. No matter what kind of retirement you dream of, it is that time in your life when you want the financial freedom and physical ability to do things that make you happy.

Secrets to retirement happiness in Canada

So, what is the secret to a happy retirement? How do you ensure that after working hard throughout your career, you can enjoy the fruits of your labour? One of the most important elements of retirement planning is deciding where you wish to stay after you stop working.

Do you plan to:

- Relocate to a place that has a warmer climate?

- ‘Rightsize’ and find accommodation in proximity to your children?

- Explore retirement communities that address your recreational and future aging needs?

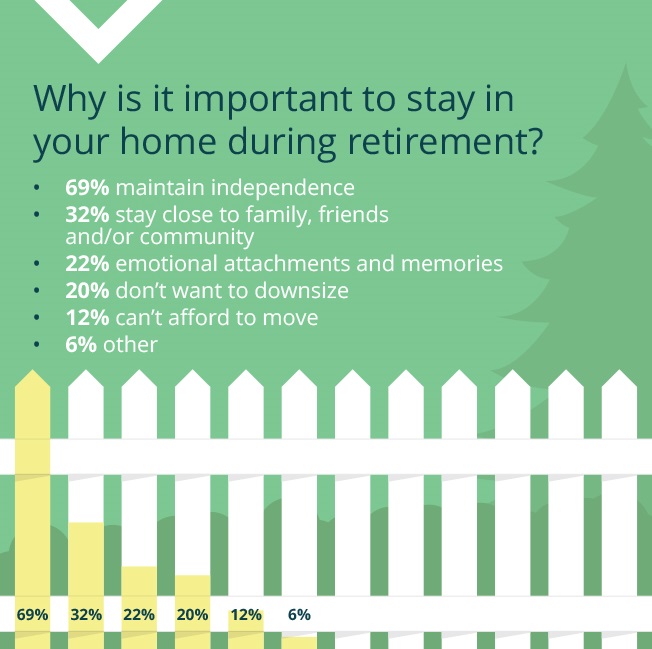

- Age-in-place in the home where you have spent years raising your family and creating emotional and physical comfort?

While finalizing your housing options is a critical aspect of retirement happiness in Canada, you may have several other thoughts and apprehensions about life post-retirement. Read on for some insightful retirement planning tips and discover the secret to a happy and perhaps early retirement.

Keys to retirement happiness

There is no doubt that financial security and good health are the pillars of retirement happiness. However, as you age, you may realize that money is not everything, and the things that money can buy start having less of an impact on your happiness. Here are a few retirement planning tips that may bring you a more joyous and fulfilling retirement.

1. Do what you love to do (hobbies, interests): Hobbies and interests can stimulate your mind, adding to your emotional fulfilment and personal satisfaction after you stop working. In fact, pursuing a hobby that allows you to explore your interests in a social environment can give you an even bigger boost of happiness, simply by virtue of being surrounded by people.

2. Stay healthy: What good are financial security or a great social circle if you don’t have the stamina or ability to enjoy them? Your health is the single most important key to your retirement happiness. Whether it is a brisk walk in the neighbourhood, window shopping in the mall, swimming in the local community pool, or training at the gym, engage in any form of exercise that helps you stay active and energetic. Adopt a healthy lifestyle and eating habits, focus on your wellness, and don’t miss your annual physical exam. Your health is one of your best companions in your golden years.

3. Fill the social vacuum: During your working years, you may spend plenty of time with colleagues and associates. However, after retirement, your daily social interaction may be limited to only your immediate family. It is important to fill that social vacuum by forging new relationships with other people who share your interests. As you age, it becomes increasingly important to stay social, and be around people.

4. Try something challenging every day: Whether you volunteer for a local charity/event, or check something off your bucket list, every small or large accomplishment provides mental stimulation, which is very important during your retirement years. Make it a habit to do something challenging every single day. Add to the excitement by encouraging your spouse, partner or a friend to partake in the activity with you. Over time, this will enhance your relationships, as well as your zest for life.

5. Be adventurous: Life is more interesting when you have something to think about, and there are many ways to achieve this.

- Indulge in travel within your country or abroad, to see and experience new places, cultures and lifestyles

- Sample a new type of cuisine every month or learn to cook a new dish to add that extra hint of spice in your life

- Try a new sport or activity that has always intrigued you, but you didn’t have the time to pursue during your working years

- Be inquisitive about new technology – there is so much to explore in this space, that you may surprise yourself about how well you adapt to unfamiliar territory

It is not enough to just crave something stimulating. You will need to work to keep your life exciting. Besides, happiness is about having something to look forward to, overcoming challenges, and having loved ones to share your experiences with.

6. Be prepared and plan ahead: As we age, we brace ourselves for many unexpected challenges, especially those related to health, unpredictable accidents, or emergencies. Accumulating some contingency funds will add a cushion of financial security. However, there are other things that you may want to plan for in order to reduce your stress, and save costly, long-term expenses. One such aspect is safely aging in place. For example, if you or your loved ones are starting to be less mobile around the house, you may want to renovate your house, install a stair lift, or fit a walk-in, seat-in bathtub to prevent potential accidents. Retirement happiness is also about minimizing potential problems and being prepared for the unexpected ones.

Retirement planning with a reverse mortgage

In Canada, it is a known fact that your personal savings and investments may or may not be sufficient to cover your entire retired life. In fact, among other retirement income tips, financial experts suggest various options for ensuring a steady cash flow once you stop working.

If you are nearing retirement age and own your home, you could explore the option of a reverse mortgage as a potential tool for a happy retirement. In addition to giving you and your spouse additional cash in hand during your golden years, a reverse mortgage has several other benefits:

- You continue to own your home and stay in it: Over the years, you create many memories in your family home, which creates an emotional connection to it. A reverse mortgage makes it possible to tap into some of your home’s equity without losing ownership or possession of your beloved property.

- No credit score is required: Since the loan is guaranteed by the value of your home, there is no need for a credit check. You do not have to worry about any income requirements while taking out a reverse mortgage loan.

- You choose how to receive the money: Get the money you need in precisely the way you want it. Whether you wish to receive your money over time, or in one lump-sum pay-out, a reverse mortgage is typically structured in such a way that the choice is yours. Likewise, if at any time you would like to repay the principal and interest in full, or switch to paying interest on an annual or monthly basis, you can do that too.*Prepayment charges may apply.

- Choose what to do with your money: You can use your reverse mortgage funds for any purpose that you desire. Give your children an early inheritance, renovate your home, travel, fortify your healthcare budget, or improve your monthly liquidity to cover household expenses. No matter what your priorities, a reverse mortgage gives you the freedom to decide what you want to do with your money.

- You and your heirs are not subject to market fluctuations: Reverse mortgage providers usually lend up to 55% of the value of your home. This ensures that you can cash out a sizeable portion of your home equity, without compromising your future financial security.

- This way, at the time of repayment, you or your heirs will likely have remaining home equity.

- A drastic depreciation in property values is rare. However, in case the gross proceeds from the sale of your home fall short of the loan repayable amount, you or your heirs are protected by HomeEquity Bank’s No Negative Equity Guarantee(1). This means, as long as your mortgage obligations are met, the amount you have to repay on the due date will not exceed the fair market value of your home. The lender will cover the difference between the sale price and the loan amount.

(1)The guarantee excludes administrative expenses and interest that has accumulated after the due date.

- The money is tax-free: Since you do not earn any additional income while benefiting from the value of your home, the money you receive via a reverse mortgage is tax-free, meaning it is not subject to federal, provincial or local taxes.

- Your co-borrower won’t have to move out if you die first: If you die first, your spouse or co-borrowers can continue to stay in the home. The loan does not become repayable until the last of the co-borrowers moves out, sells the home, or passes on.

Here are a few aspects to keep in mind while considering a reverse mortgage:

- Fees: Like any type of mortgage, there are fees, closing costs and administrative charges associated with the transaction. Inquire about all the costs and benefits before you sign any loan agreements.

- Taxes and insurance: A reverse mortgage offers tax-free, disposable cash that you can use as you see fit. However, under the terms of most reverse mortgage agreements, if you fall behind in your property tax or insurance payments, the loan may be considered in default. Though these situations are rare.

What happens to your property after you die?

One aspect that most people want to clarify while considering a reverse mortgage is the impact of the mortgage inheritance on their heirs.

Here’s the answer to “What happens to the house after I die?”

- In the event of death of one of the homeowners (your spouse or co-borrower), if you are on title, you won’t need to repay the loan and can continue to stay in the home. A reverse mortgage becomes payable upon the death of the last co-borrower, or if you (as the borrower) sell your home.

- Essentially, the equity covers the loan amount and other processing fees. The heirs or the borrower will have an option to pay off the loan to the lending financial institution and retain the property. Any proceeds over and above the loan amount are the heirs to keep. Alternatively, the lending financial institution can sell the property to redeem its dues and hand over any remaining balance to the heirs.

- Keep in mind, that while you may have fond memories of raising your family in your home, your children may not be interested in retaining, or moving back to the house where they grew up. This is especially true in the rare chance that there is no equity left in the property. In that case, the heirs have the option to sign a foreclosure deed, turn over the keys to the lender, and choose not to be part of any further dealings related to the property.

Improve your retirement portfolio with the CHIP Reverse Mortgage®

Over the years, the reverse mortgage product has seen many positive changes. In the past, these loans were seen as a financial tool of the last resort. Today, now that they are more informed, many financial experts believe that a reverse mortgage can be a strategic tool that can vastly improve a retiree’s portfolio, especially over a lengthy retirement. The key is to use a reverse mortgage as part of a coordinated retirement planning strategy, at the onset of retirement.

If you are a Canadian homeowner, 55 years or older, with a reverse mortgage you can access up to 55% of the value of your home in tax-free cash and be well on your way to a happy and fulfilling retirement.

Learn how the CHIP Reverse Mortgage can enhance the success of your retirement portfolio and be an important key to your retirement happiness. For more information on using a reverse mortgage in your retirement planning strategy, call us at 1-866-522-2447 or get our no obligation guide.