Chapter One: Canada’s Unstoppable Real Estate Market

In Home Run: the Reverse Mortgage Advantage, co-author Yvonne Ziomecki, Executive Vice President of Marketing and Sales for HomeEquity Bank remarks: “My two daughters and I love our current house and our neighbourhood.” That’s a sentiment so many of us can echo and appreciate. We enjoy where we live and, after experiencing life during a pandemic, we also understand how fortunate we are to reside in a comfortable, safe home that shelters us during this trying and often scary time.

We also understand that everything is changing for retirees in the third decade of the 21st century. The new book by Ziomecki, and her co-author, HomeEquity Bank President & CEO Steven Ranson, is about how best to manage change and embrace your retirement while remaining financially secure and with the funds to live the life you’ve dreamed. The book is a straightforward, candid resource for those age 55 years and up (and their children) who are considering how to ensure that the retirement years are safe, secure and enjoyable.

The first topic discussed in Home Run is “Canada’s Unstoppable Real Estate Market.”

Canadians who purchased their home anytime during the last 50 years can appreciate the true meaning of the unstoppable real estate market in Canada, and how equity in our homes changes our personal balance sheet for the better. The value of our homes has been rising for decades and has created considerable wealth for homeowners. This accumulation of wealth has taken place at a time when wages have not risen substantially for many middle-class families, while at the same time the gold standard in pension plans, the defined pension plan, is something that a decreasing number of people have. In fact, only 10 percent of private sector workers are covered by defined-benefit pensions—about a third of the coverage of the late 1970s.

The indisputable fact that many Canadians have been caught off guard and not saved adequately for retirement makes us reconsider the centrality of our homes to our well-being, to the cohesiveness of our family and to the quality of the retirement we can hope for.

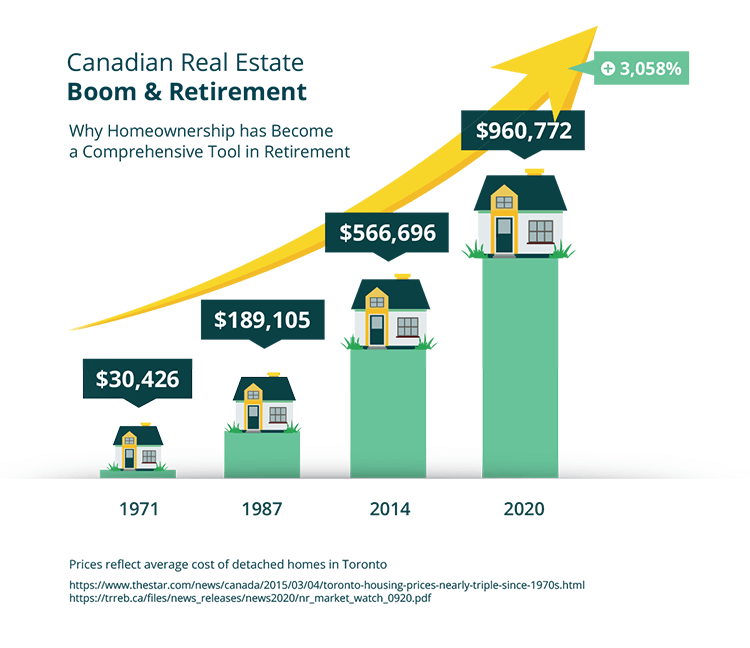

As the authors write in Home Run, “Average prices in Toronto have gone from $30,426 in 1971 to $189,105 in 1987 to $566,696 in 2014. More recently, the Toronto Real Estate Board for October 2020 shows that the average sale price was $960,772—up by 14 percent year over year. The climb continues in the rest of the country as well: the Canadian Real Estate Association reported in September 2020 that the average price of a Canadian resale home was $604,000, up 17.5 percent from the average price a year earlier. You only need ask a boomer to confirm that the investment in property, particularly when it’s your own home, is extraordinarily worthwhile.”

Across the country this unstoppable rise in home prices has happened as interest rates have fallen to historic levels. But there’s another side to this picture, and it concerns debt and the years we’ve worked to stay on top of our debt. According to Statistics Canada, the proportion of senior families with debt was 42 percent in 2016, up from 27 percent in 1999. The median amount of debt was $25,000 in 2016, up from $9,000 in 1999 (expressed in 2016 constant dollars). The share of those with consumer debt increased from 24 percent to 37 percent, according to Ziomecki. Coinciding with holding increasing debt, older Canadians are working longer than we did in the 1990s. In fact, Statistics Canada noted that, according to a Labour Force Survey, workers in 2017 were retiring on average at 64 years of age, almost three years later than in the late 1990s.

When we look at our financial balance sheet, it’s no wonder we’re anxious about how we’re going to make it through our retirement in a safe and comfortable way—with a little extra for those vacations or renovations or just the little treats we all rely on to get us through the day. That is exactly where a reverse mortgage comes in. The CHIP Reverse Mortgage offers Canadians 55 years and older a savvy way of putting to excellent use the equity in our home while avoiding the high cost of downsizing.

As Ziomecki & Ranson write in Home Run: “Consider the expenses involved with moving: the cost of realtor fees being one enormous expense. Five percent on the October 2020 average Toronto home price of $960,772 equals more than $48,000 in realtor fees. Then add a few thousand more for lawyer fees, plus the cost of moving and likely the need for new furniture at the new home. In the end, a homeowner might have to subtract over $50,000 from that sale price.”

With months of the pandemic behind us, we’ve had time to consider what home means to each of us and to our families. We’ve had time to savour the investments we’ve worked so hard for and put into our homes—and to appreciate how our homes are able to show us the same consideration—by turning those monthly mortgage payments into a comfortable retirement.

If moving out is not for you, be prepared to learn a great deal about how reverse mortgages work by reading Home Run: The Reverse Mortgage Advantage. (Now might just be the perfect time to inquire about how a reverse mortgage can help make the retirement you dreamed of a reality.)

A valued bi-weekly contributor to HomeEquity Bank’s CHIP Reverse Mortgage – Canada’s Leading Plan | HomeEquity Bank blogs, Joyce Wayne leverages her expert knowledge to explore critical lifestyle topics relevant to retirees and soon-to-be retirees. She skillfully delves into areas of successful aging, retirement lifestyle, and aging in place, providing a wealth of insights amongst other lifestyle topics. As an acclaimed novelist and essayist, Wayne has an established background, including her bestseller “Last Night of the World” and commendations from ‘Best Canadian Essays’ and ‘The Literary Review of Canada’. Her distinguished experience as former editorial director at McClelland & Stewart Publishers and Quill & Quire further enriches the work she does for HomeEquity Bank and the readers.

Joyce Wayne

DON’T MISS OUT!

Get the latest news, retirement tips, and special offers sent right to your inbox.

Check your inbox for future updates.

The CHIP Reverse Mortgage is exclusively for Canadians 55 and older. Based on your information, you are not eligible at this time. We invite you to visit our partner’s site RATESDOTCA, to receive quotes for alternative solutions that may better fit your needs.

GET YOUR FREE QUOTE

Follow @JoyceWayne1951

Follow @JoyceWayne1951