Chapter Two: The Reverse Mortgage Advantage

If you’re like me, I’m often up late at night worrying about how to ensure that my retirement will be a comfortable and secure one. These are the questions that keep me awake into the early hours of the morning:

- Will the funds I’ve accumulated during my career last for my lifetime?

- If I become ill, will I be able to afford the care I need?

- When should I begin divesting my assets as I age, and what accounts should be cashed out first?

- Are there alternatives to cashing out my assets?

- How can I leave a legacy for my daughter and my husband?

Older Canadians face these questions at some point, although I’m pretty sure most of us don’t like to dwell on them until the harsh realities of aging present themselves. Since the crisis in long-term care homes intensified as COVID-19 spread throughout many facilities, it’s been a wake-up call for older Canadians who once thought that public or private long-term care homes were an answer to our fears about aging. It has prompted many of us to put more thought into the idea of aging in our own homes.

If you’re interested in exploring how to make aging at home a reality for you, then I highly recommend the new book by HomeEquity Bank’s President & CEO Steven Ranson and Executive Vice President of Marketing & Sales Yvonne Ziomecki, Home Run: The Reverse Mortgage Advantage. It is an easy-to-read, no-nonsense primer on how to put your fears about aging to rest by considering a reverse mortgage as the solution to financial concerns.

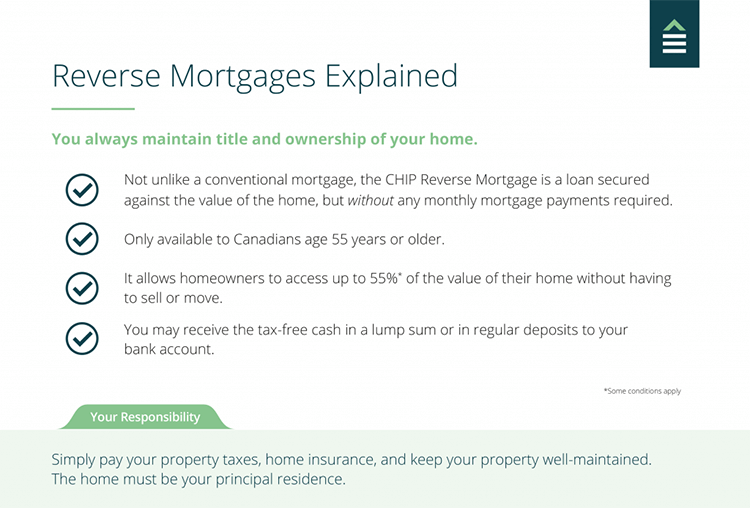

Here’s how a reverse mortgage works: It’s a loan that allows you to access the equity in your home without having to sell it. The loan is secured against the value of your home. Unlike a traditional mortgage, you don’t have to make mortgage payments to HomeEquity Bank until the home is sold.

The basic qualifications for a CHIP Reverse Mortgage are straightforward:

- Customers must be 55 years old or over and own their home.

- Everyone on the application (and home title) must be 55 years old or over.

- The home must be the client’s primary residence.

- The home’s value must be over $200,000.

If you are concerned that the reverse mortgage could affect government-sponsored pensions or that you could lose ownership of your home, you needn’t be. The fact is, the money you borrow is tax-free and it doesn’t affect your Old Age Security or Guaranteed Income Supplement (GIS) benefits. And you always remain on title and retain ownership of your home.

The CHIP Reverse Mortgage is a non-recourse loan, which means that at the time of repayment, you or your estate will never owe more than the fair market value of your home as long as you have maintained your property and kept it in good condition, paid your property taxes and have valid homeowner’s insurance. This is HomeEquity Bank’s “No Negative Equity Guarantee.”

When you qualify for a reverse mortgage, you never need to worry that HomeEquity will take over the ownership of your home and you will never owe more than the fair market value of your home. Unlike a regular mortgage, you don’t make regular mortgage payments on a reverse mortgage. This is the biggest benefit of the product: it allows you to stay in your home with no monthly mortgage payments. You can use the money from a reverse mortgage to pay any mortgage, debt or lien against your home.

With HomeEquity Bank offering a number of different ways to access the equity in your home, you’re free to receive a lump sum of the amount you borrow as monthly advances over time. Or you can even take out a portion of the amount you qualify for and put the rest aside for when you might need it. Home Run: The Reverse Mortgage Advantage details the goods on the range of flexible products that HomeEquity Bank offers, allowing you to discern which one would suit you best.

You can find all the details on how to apply for a CHIP Reverse Mortgage on the website as well as in Home Run. I read an advance copy of the book and, as I was reading, my worries about retirement began to melt away. The book describes the methods I could employ to ensure that I remain in my home as I age—and not be forced into a long-term care facility if I should need support. It clearly describes how I can handle managing staying in my home even if I’m faced with mobility issues and how I can feel confident that I will be able to leave a legacy for those I love.

After reading Home Run, I found I could sleep better at night and, let me tell you, that’s reason enough to order the book.

A valued bi-weekly contributor to HomeEquity Bank’s CHIP Reverse Mortgage – Canada’s Leading Plan | HomeEquity Bank blogs, Joyce Wayne leverages her expert knowledge to explore critical lifestyle topics relevant to retirees and soon-to-be retirees. She skillfully delves into areas of successful aging, retirement lifestyle, and aging in place, providing a wealth of insights amongst other lifestyle topics. As an acclaimed novelist and essayist, Wayne has an established background, including her bestseller “Last Night of the World” and commendations from ‘Best Canadian Essays’ and ‘The Literary Review of Canada’. Her distinguished experience as former editorial director at McClelland & Stewart Publishers and Quill & Quire further enriches the work she does for HomeEquity Bank and the readers.

Joyce Wayne

DON’T MISS OUT!

Get the latest news, retirement tips, and special offers sent right to your inbox.

Check your inbox for future updates.

The CHIP Reverse Mortgage is exclusively for Canadians 55 and older. Based on your information, you are not eligible at this time. We invite you to visit our partner’s site RATESDOTCA, to receive quotes for alternative solutions that may better fit your needs.

GET YOUR FREE QUOTE

Follow @JoyceWayne1951

Follow @JoyceWayne1951