Chapter Four: The Joy of Aging in Place

In this chapter of Home Run: The Reverse Mortgage Advantage, Executive Vice President of Marketing & Sales Yvonne Ziomecki and President & CEO Steven Ranson ask, what does “aging in place” mean? The federal government’s ministry responsible for seniors defines aging in place as “having the health and social support and services you need to live safely and independently in your home or your community for as long as you wish and are able.” I’m about to turn 70 this year, and as I do, I’ve come to realize how complicated that definition is. What does it actually mean? The answer will be a bit different for everyone.

For me, first and foremost it means living in a safe, well-situated and pleasant home. And that’s only the beginning. I want a good-sized bedroom, my washroom nearby, and a well-designed kitchen where I can cook for myself, my husband and our guests when we invite friends or family to visit. It also means a private space to work because I’m a writer and, without privacy, writing is next to impossible. It also means decent-sized windows to let in the light, storage space for clothes and belongings and, most importantly for me, much wall space for bookshelves and art. These must-haves might make me sound fussy and demanding, but if you think about it, who doesn’t wish for at least some of these conveniences?

What each of us wants is “health and social support,” as the government describes it. But that means so many different things to different people. For me, it means having my husband with me so we can support each other in good times and bad. It means knowing that my daughter is close by for companionship and in an emergency. As well, we want to know that our neighbours and our community are welcoming and that our doctors and our hospital will take good care of us if we fall ill.

As Ranson and Ziomecki write in Home Run: The Reverse Mortgage Advantage, our financial resources are not always there to back up our priorities as we age. “While we’re inspired when our clients take action to improve their finances, we have to admit we’re sometimes worried by some of the situations people are in when they first come to see us,” they share. “Sometimes, prospective clients are anxious and in crisis. They’re also looking for a solution, but maybe they’ve waited and worried too long. Sometimes the place they are coming from is dark. It brings to mind this quote by playwright Tennessee Williams: ‘You can be young without money, but you can’t be old without it.’”

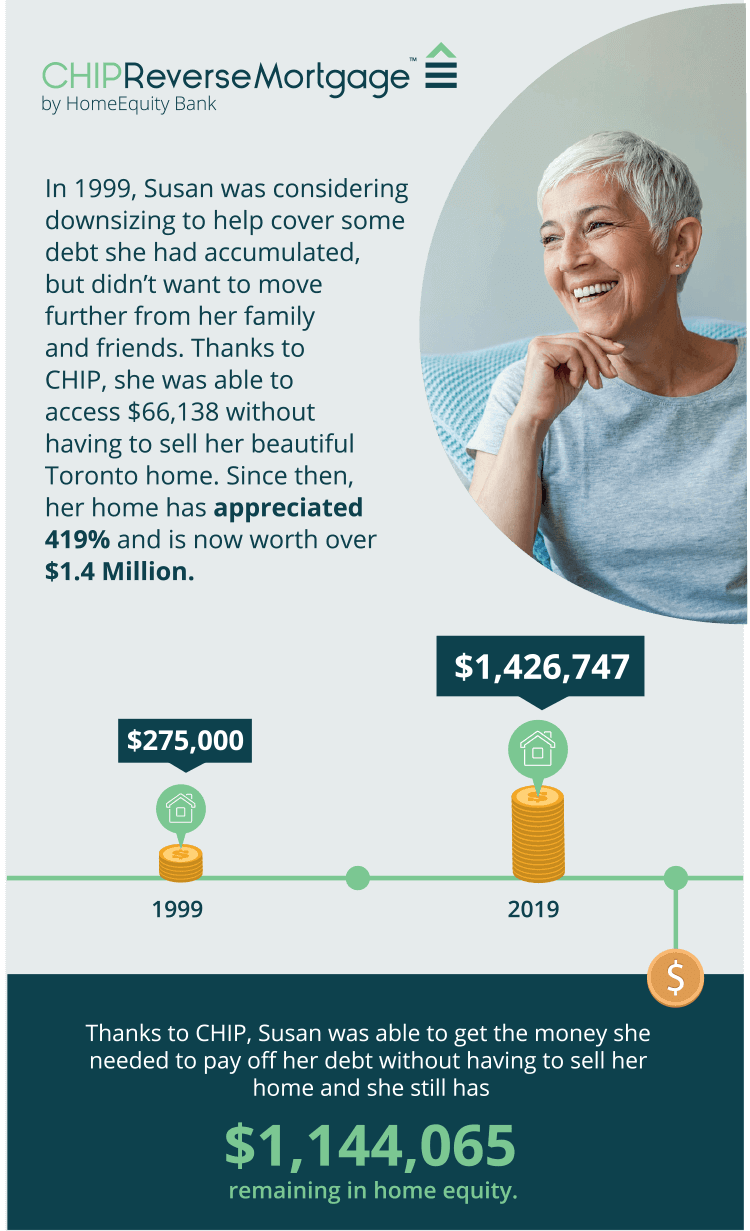

Ranson and Ziomecki go on to say, “At HomeEquity Bank, we all believe that people in retirement deserve to be proud and feel empowered, not stressed and ashamed.” And that’s where a phone call or an email inquiry to HomeEquity Bank can make the difference between facing cash flow problems or finding a reasonable solution to those problems by investigating how a reverse mortgage could work for you. If you start looking at your home as a money-maker, you might be surprised by how financially savvy the reverse mortgage is. As Ranson and Ziomecki point out, arranging a line of credit on your home, downsizing or tightening your belt are often not reasonable ways to fund your retirement. Similarly, selling your home to re-locate in an apartment is another option that demands much more scrutiny.

“The reverse mortgage is the other option we’re trying to make people see in our new book, Home Run: The Reverse Mortgage Advantage,” advise Ranson and Ziomecki. “They can still view their house as a source of money, but in a different way. Homeowners have this amazing investment with a real estate market that’s been on fire for the past two decades. Even just by calling to find out what’s possible with the reverse mortgage, people have moved out of inertia into action. Then, when they take it up, their world opens up to possibility. All those modest things that were thought of as nice-to-haves (but are really more than that) become within their means.”

“When you’ve already made this amazing investment in a house, why wouldn’t you get that investment to work harder for you and fund the life you actually want?” Ranson and Ziomecki ask. “That lifestyle is within your reach. Or even just the calm that comes from not having to pinch every penny. It’s so freeing.”

A valued bi-weekly contributor to HomeEquity Bank’s CHIP Reverse Mortgage – Canada’s Leading Plan | HomeEquity Bank blogs, Joyce Wayne leverages her expert knowledge to explore critical lifestyle topics relevant to retirees and soon-to-be retirees. She skillfully delves into areas of successful aging, retirement lifestyle, and aging in place, providing a wealth of insights amongst other lifestyle topics. As an acclaimed novelist and essayist, Wayne has an established background, including her bestseller “Last Night of the World” and commendations from ‘Best Canadian Essays’ and ‘The Literary Review of Canada’. Her distinguished experience as former editorial director at McClelland & Stewart Publishers and Quill & Quire further enriches the work she does for HomeEquity Bank and the readers.

Joyce Wayne

DON’T MISS OUT!

Get the latest news, retirement tips, and special offers sent right to your inbox.

Check your inbox for future updates.

The CHIP Reverse Mortgage is exclusively for Canadians 55 and older. Based on your information, you are not eligible at this time. We invite you to visit our partner’s site RATESDOTCA, to receive quotes for alternative solutions that may better fit your needs.

GET YOUR FREE QUOTE

Follow @JoyceWayne1951

Follow @JoyceWayne1951