March is Fraud Prevention Month in Canada, and HomeEquity Bank is sharing practical tips to help Canadians aged 55 and up educate and protect themselves from online scams.

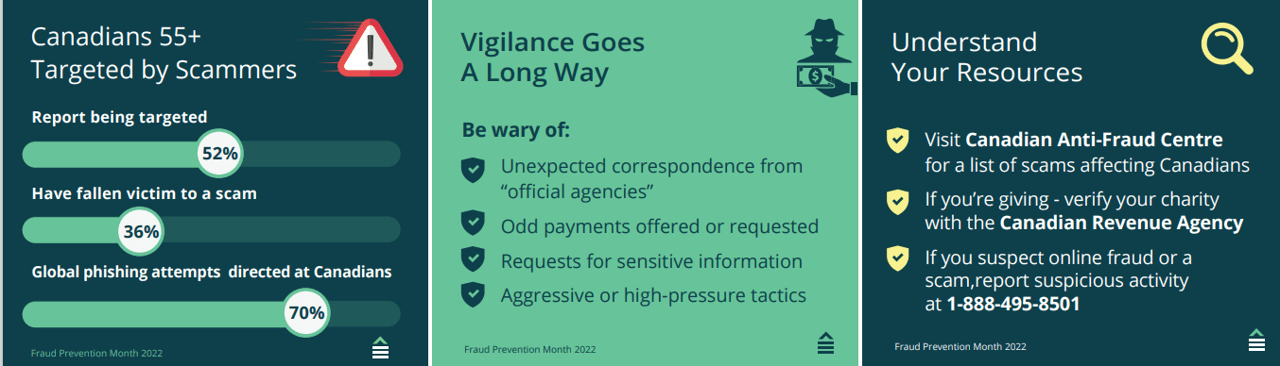

Staying fraud-smart is especially important for Canadians aged 55 and up. More than half of this demographic (52%) report being the target of an online scam in the past, and over a third (36%) have fallen victim to a scam. Canadians 55 and up are targeted by scammers for two main reasons: the perception they aren’t technologically savvy, and that they’re inherently trusting of others – vulnerabilities that can be all-too attractive to online fraudsters. And when you consider the following, that a staggering 12,252 online frauds totaling $75.5 million have already been reported in 2022, and a projected 60% of people over 45 will receive fraudulent emails by the end of this year, it certainly makes good sense to stay informed.

“Technology makes our lives easier in many ways, but it can also expose us to a range of online fraud,” says Roger Favero, EVP of Data and Technology at HomeEquity Bank. “Sadly, these types of scams affect a growing number of Canadians. It’s always better to be safe than sorry and little vigilance goes a long way – we need to educate ourselves about the risks and dangers, and understand how to protect our parents, loved ones, children, and ourselves.”

Online Scams: Things to Look Out For

Correspondence from “official” agencies and organizations

If you’re not expecting an important message from a government body, proceed with caution. Many scammers pretend to be from entities like the Canadian Revenue Agency (CRA), or to be calling about new initiatives such as “license plate sticker refunds.”

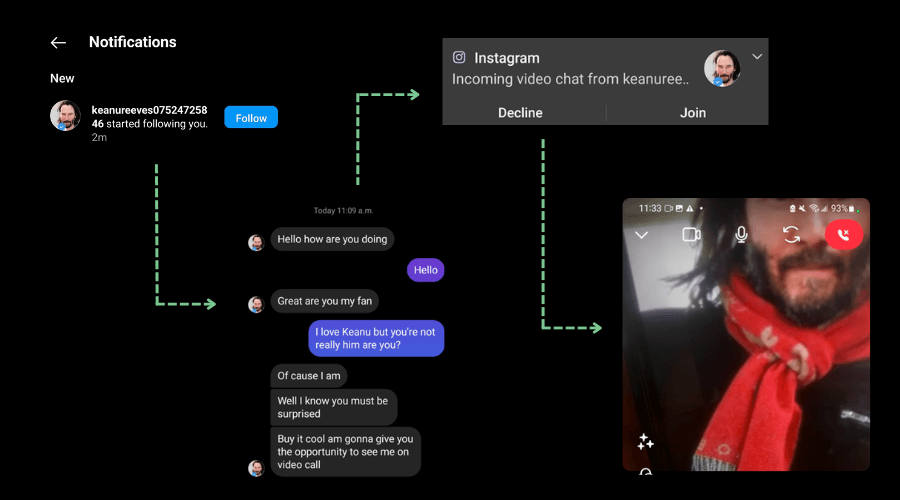

Know who to trust

Feeling unsure about a recent call, email, or text? Check to see if it’s one of the scams identified by the Canadian government in this extensive list, and review the information with your partners, parents, and children. Any suspicions you may have are probably well-founded, since nearly 70% of the world’s fraud phishing is directed at Canadians.

Unusual payment methods and information requests

A certain indicator of fraud can be an odd payment method being offered or requested – iTunes or Amazon gift cards are common examples of this scam (and no official group would ever use such payment methods). Likewise, requests for sensitive credit card, social insurance, and computer password information should automatically be considered a scam.

Charity Scams: Fraud During a Crisis

Ensure the charity is registered

Canadians looking to donate in times of crisis can create a range of new opportunities for scammers. Legitimate Canadian charities overseeing relief efforts (such as the Canadian Red Cross) must be CRA registered. If a charity solicits a donation from you, search for and confirm their BN/registered number on the CRA’s list of registered charities.

Never give out personal information

This includes your full name, address, social insurance number, birthday, credit card number, passwords, or anything else sensitive. Many legitimate callers will already have this information and shouldn’t need to get it from you.

Watch out for aggressive tactics

High-pressure, aggressive fundraising should also raise an eyebrow. If a caller is overly persistent in asking for your information or looking for upfront fees for prizes or deliveries, it’s always best to hang up immediately, do additional research, and call the agency or charity back to verify everything.

If you suspect online fraud or a scam, you can report suspicious activity at 1-888-495-8501.

To learn more now about how you can avoid fraud and scams, visit Catch The Scam