CHIP Home Equity Calculator

First, tell us a little about you and your home

Please enter first name. SKIP

March 31, 2019

A reverse mortgage is a loan that allows you to access some of your home’s equity without requiring you to sell or pay any regular mortgage payments. But what exactly is home equity? Home equity is the difference between the market value of your home and any remaining loans that are owed on the property.

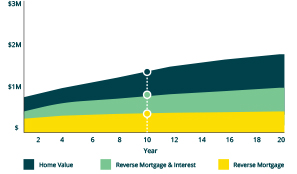

Gertrude, below is your personalized report. Based on your inputs, here is a summary of what your reverse mortgage and home equity could look like over time.

Approximate Home Value:

$500,000

Reverse Mortgage Amount:

$100,000

Selected Product:

CHIP

Reverse Mortgage

Years Remaining in Home:

10 years

Interest Rate Term:

5 years

Annual Home Appreciation Rate:

6%

Today

In 10 Years

Home Value

$1,000,000

$1,480,244

Reverse Mortgage

$500,000

$500,000

Interest

$0

$403,054

Remaining Home Equity

$500,000

$577,191

After 10 years you could have $272,009 remaining in home equity.†

$2222

Home Value

Reverse Mortgage + Interest

Reverse Mortgage

Year

Principal

Interest Rate

Accrued Annual Interest

Estimated End of Year Mortgage Balance

Estimated Future

Home Value

Estimated Remaining Home Equity

0

$500,000

6%

$ -

$500,000

$1,000,000

$500,000

1

$500,000

6%

$30,450

$530,450

$1,040,000

$509,550

† Your remaining home equity is $0 because you cannot have less than $0 equity, even though your reverse mortgage and interest balance is greater than your home value.

1 Planned advances are subject to the current variable interest rate, the initial advance amount is subject to the interest rate selected.

2 Special interest rates are subject to the selected term and will reset to the posted interest rate upon expiration of special interest rate term.

Gertrude, based on your inputs, after X years you could have $XXX remaining in home equity.

Benefits of the CHIP Reverse Mortgage®

Access up to 55% of the value of your home in tax-free cash without having to sell

Funds received are tax-free and can be used for whatever you choose

No monthly mortgage payments required

Convenience of regularly scheduled advances

Provides you with additional income

Preserves investment portfolio & lowers long-term tax liabilities

No monthly mortgage payments required

Get access to cash for large unforeseen expenses

Funds received are tax-free and can be used for whatever you choose

Avoid high-interest loans or an additional mortgage

No monthly mortgage payments required

Access your home equity for short-term needs

Repay 100% of balance at any time with no prepayment charges

Flexibility to convert to a longer-term reverse mortgage solution at anytime

No monthly mortgage payments required

Ready to take the next step?

How to apply

Access up to 55% of the value of your home – the process is simple!

Estimate

Find out how much money you can get with a free estimate

Review

Our consultants and specialist will contact you to verify your information and answer questions

Receive

Receive the money you need in one lump sum or installments

Payment

There are no monthly mortgage payments required. The full amount becomes due when you are no longer in the home

Don't wait!

Call us now to access your tax-free cash.

*Calculation results and chart are approximations based on the data you have entered and are for illustration purposes. HomeEquity Bank does not make any representations or warranties with respect to the calculation results. External factors are not accounted for in the calculations and may affect future projections and are based on certain assumptions. The rate entered is a sample rate and is not considered a rate guarantee. HomeEquity Bank may change or update calculations without notification. This information is not intended as specific financial, legal, or tax advice for any individual and should not be relied on as such. Should the home owner decide to proceed, an independent appraisal of the home, among other things, will be required in order to establish a precise evaluation.

Please review our privacy policy for details on how we handle and use your personal information.