By Joyce Wayne

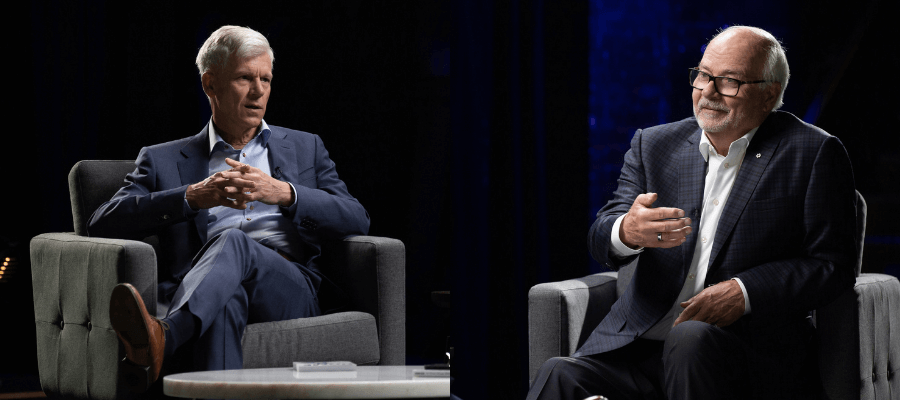

The most recent Facebook video in the HomeEquity Bank series “Peter Mansbridge In Conversation” shines a light on aging in place and how a CHIP Reverse Mortgage can help make that possible.

During the discussion with acclaimed journalist and Canadian icon Peter Mansbridge and HomeEquity Bank President and CEO Steven Ranson, the conversation was all about aging in place, the preferred choice of over 90 percent of Canadians.

What Does Aging in Place Mean?

First, Mansbridge asked Ranson to describe what aging in place means. “That’s easy,” replied Ranson. “You get to stay in your house for as long as you wish.”

Mansbridge suggested that most homes in Canada were built for more than two people, but now it appears that older Canadians want to stay in that same home. Ranson replied by saying, “I love my house. When my kids get married, I think about hosting receptions for them. Our home will always be where they can come back for family events, birthdays, Christmas, and other holidays.

Challenges to Aging in Place

“What are the challenges to aging in place?” asked Mansbridge, to which Ranson replied by explaining that as people age, “it takes more work to maintain a home they purchased years ago. The home often needs to be modified to work for older people differently than it did when they were young.”

“So, it takes more money, and that’s where the reverse mortgage comes in,” questioned Mansbridge?

In response, Ranson described what people often need to remain in their homes, such as a ramp for a wheelchair or a stairlift for getting to the next floor. That’s why customers can take the money in small amounts, not in one lump sum and use the funds as the expenses arise. They can pay for a support worker, someone to clean the house and cut the grass. “A reverse mortgage is an affordable way to age in place, and it’s still less expensive than moving into a care facility. Today there is a general awareness that aging in place is much preferred from both a lifestyle and cost perspective,” Ranson added.

Key Questions when considering a CHIP Reverse Mortgage

Mansbridge asked Ranson to take him inside the discussion he or his staff would have with an older couple considering a reverse mortgage.

“Our first key question”, Ranson replied, “Is what do you need the money for? We want people to make the right decisions that work for them. We want them to only take out the money they really need to meet their needs.” Ranson continued, “Not everyone needs a chunk of cash. In some cases, small monthly payments work best.”

Our second key question is, “how can we help you to design a program tailored to your needs,” Ranson said.

Family Discussions and the CHIP Reverse Mortgage

Peter Mansbridge’s last question was how important is it to discuss the CHIP Reverse Mortgage with the family, to which Steven Ranson replied, “It takes 25 days to arrange for a reverse mortgage. I suggest talking it over with your family and with your own lawyer.”

There are good reasons why HomeEquity Bank’s CHIP Reverse Mortgages are increasingly becoming the go-to alternative to selling your home and moving to a care facility or a condo. Not only can you remain in the home you love, in the neighbourhood you know, but with this mortgage, you can afford the modifications to your home that create a safe and secure environment. Importantly, you can be your own person and pursue the life you want while living independently, in charge of your decisions and day-to-day lifestyle.

Watch the replay of this exciting Peter Mansbridge In Conversation with Steven Ranson.