Many Canadians consider downsizing at some point in their retirement. After the kids have moved out, it can seem like a no-brainer: move to a smaller home or one in a cheaper town and cash in the difference in price.

For many retirees, the money they can get from the sale of their home can make a big difference to their lifestyle and finances in general.

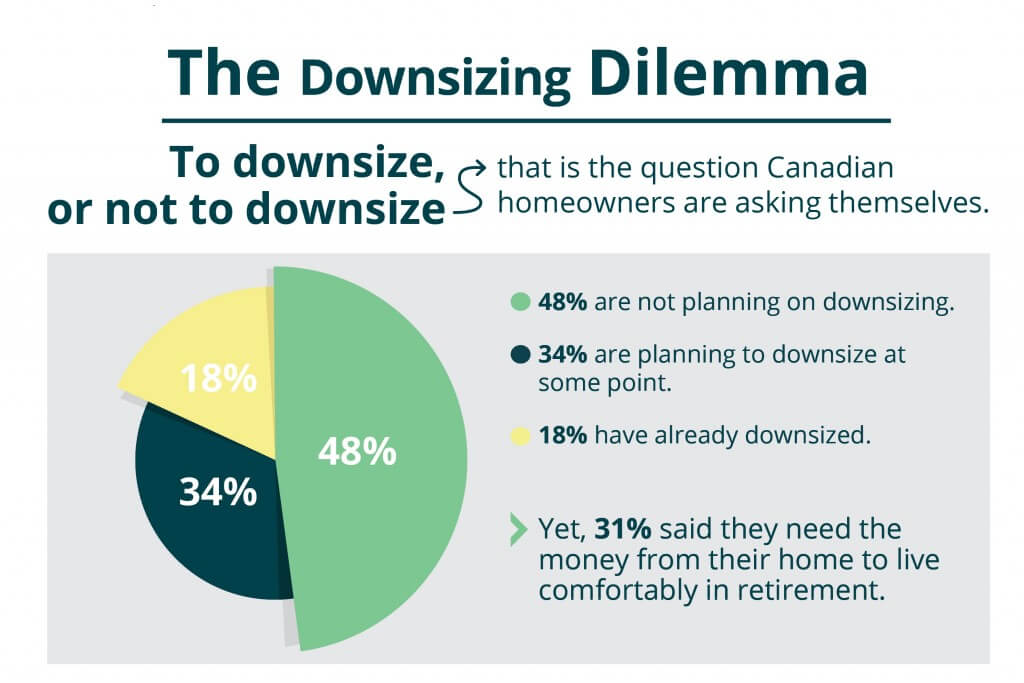

However, downsizing in Canada isn’t quite as simple as that. According to an Ipsos survey, half of baby boomers have no plans to downsize at all and many are not aware of the true costs that can come with downsizing. So, what are the effects of downsizing for retirement, and what costs – both emotional and financial – should you be aware of?

What is downsizing after retirement?

Downsizing is typically the process of selling a much larger home and buying a smaller one, often a bungalow, condo, apartment or townhome.

Downsizing after retirement was once a popular option for retirees. Due to various reasons relating but not limited to finance, maintenance, emotions, some Canadian retirees choose to downsize to a smaller property and/or move to a smaller town if they are from the city.

Apart from the fact that there is a considerable difference in the square footage of the two homes, there is typically a substantial difference between the selling price of the old home and the purchase price of the new one.

Benefits of downsizing in retirement

There are many different reasons why someone might consider downsizing your home after retirement, but on average, they tend to take two forms: practical and financial. Here are some of the more typical reasons for downsizing in Canada:

- To pay off their conventional mortgage and/or other debt

- To cut monthly bills (heat, hydro, municipal taxes, etc.)

- To reduce the amount of housework, yard work and/or maintenance required

- To move closer to loved ones

- The winter is spent away, therefore they don’t live in their home year-round and so don’t need such a big place

- They need extra cash to help fund their retirement

- Their home is too big for them

However, many retirees are not aware of all of the potential negative effects of downsizing after retirement. It can bring with it financial, emotional, practical and health costs. Joyce Wayne, of Oakville, Ontario decided to downsize just over 10 years ago.

“I understand why people want to sell,” she says. “They can get equity out of their home.” Joyce expected to make a healthy profit that would help fund her retirement. But now she says she made a mistake. The costs of downsizing in Canada – both financial and emotional – were much higher than she expected. Eventually, Joyce upsized.

Why downsizing in retirement might be a terrible idea

Downsizing in retirement may not be a suitable option for most Canadian retirees for reasons related but not limited to home maintenance costs, moving costs, and the costs associated with buying a new home and of course, the emotional cost of moving away from the home and community you love.

Most of us don’t want to move – in fact, 93% of us hope to age in our family home. But some retirees think that downsizing is the only solution to their financial problems. If that is your key reason for downsizing, it’s important to be aware of all of the costs involved, as well as the alternatives.

The financial cost

While there are plenty of downsizing tips available, few of them discuss the expenses involved. This could be one reason why many retirees are unaware of the true costs of downsizing in Canada. The Ipsos survey quoted earlier discovered that 41% of homeowners don’t actually know how much it would cost to downsize. Furthermore, 39% of homeowners are skeptical that downsizing will actually save them any money.

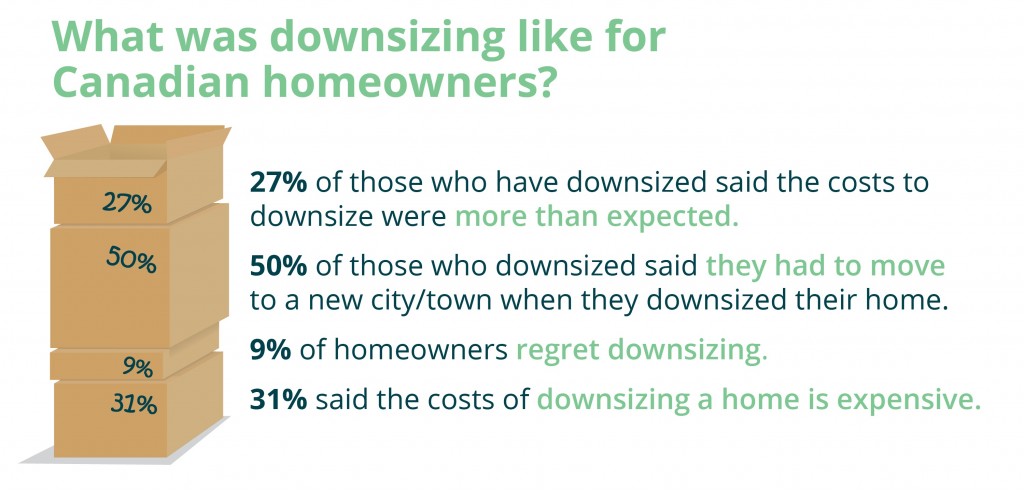

This is not too surprising, considering 31% of those homeowners who did downsize found that the costs were more than they expected. Like these Canadians, you might not be aware of all of the expenses involved. To help you to understand how much downsizing could actually cost you, these are some of the typical, unexpected costs that many people are unaware of.

The cost of fixing up your home:

Houses typically need sprucing up before they go on the market.

- Sometimes that might mean a fresh coat of paint or a couple of minor repairs, but sometimes it can mean completing a kitchen renovation, as Joyce Wayne felt compelled to do, or putting on a new roof. Many homeowners also pay to stage their home. Not surprisingly, downsizing tips rarely mention these costs, which can run into the tens of thousands.

The cost of parting with your belongings:

Another negative effect of downsizing comes about simply by moving into a smaller space. Your new home won’t be able to house all of your furniture and other possessions. You may need to make tough, even heartbreaking choices about what you can keep. Joyce couldn’t bear to part with some of her things and so ended up paying $185 a month for a storage unit.

The cost of selling, moving and buying:

There are considerable costs involved in selling your home and buying and moving into a new one. These include:

- Realtor commission

- Title insurance and legal fees

- Land transfer tax (the amount varies from province to province)

- Moving expenses

- New furniture for the smaller home

- Condo fees

Downsizing in Canada: a cost analysis

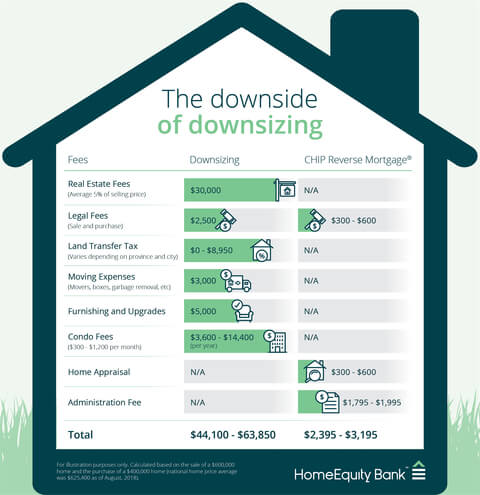

The costs of moving are probably the most significant of all negative effects of downsizing. To give you an idea of the figures involved, we carried out a cost analysis for a fairly typical downsizing scenario. We used an example of selling a $600,000 house and buying a condo for $400,000.

In theory, this would free up $200,000 in equity while moving you into a smaller home. This is the kind of income boost you would need to have a meaningful impact on your retirement finances. But how much of that chunk will you actually get to keep in order to boost your nest-egg?

As you can see, downsizing could cost you between $44,100 – $63,850.

If you live in a big city like Toronto, your $200,000 of equity could shrink to just $136,150, as a negative effect of downsizing*. This is a huge chunk of your money that disappears into thin air after you downsize. However, these costs are not the only negative effects of downsizing to consider.

The practical costs

In order to find a suitable home that’s cheap enough to make downsizing in Canada financially worthwhile, retirees often need to move to a new neighbourhood or even a different town. This can mean leaving friends, neighbours and that café where the owner always knows your coffee order.

“I had a great neighbourhood,” Joyce admits. However, after downsizing, she says, “I missed the shopkeepers, and I missed the recreation centre where I went swimming.” Less expensive homes are often less centrally located, meaning you’re further away from theatres, art galleries and other amenities, at a stage in your life when you may be looking forward to more leisure time.

One further negative effect of downsizing is moving into a smaller living space. It can be a real challenge to maintain a similar lifestyle to the one you enjoyed in your previous, larger home. If you enjoy hosting dinner parties or out-of-town friends and relatives, losing these activities could be a big blow.

Joyce was frustrated that she didn’t have sufficient space for guests. “Entertaining is a real pleasure for me, and I didn’t want to give that up,” she says. Some homeowners may also want to keep an extra room for their adult children to move back into, if needed. Statistics Canada recently reported that 42% of young adults in their 20s are living with their parents.

The emotional costs

Many people live in their family home for decades and some live in what was once their parents’ home. These places can hold fond memories for many retirees, including a happy marriage, raising children, birthdays, anniversaries, holidays and parties.

Moving away from a home that holds so many happy memories, especially if the retiree is widowed, can be a huge wrench.

The health costs

Research suggests that getting outside regularly is key to maintaining good physical and mental health. For those people moving from a house with a garden to a condo, the change can be significant.

The benefits of spending time outdoors include reduced stress, combatting depression, improved mental energy, lowered blood pressure and better sleep.

In a condo unit with no garden and a bank of elevators to reach the front door, people lose that easy access to the outdoors. After Joyce left her beloved backyard, she says, “I found that I really missed not being able to sit out on the grass or plant a few flowers.”

Alternative to downsizing in Canada: the cheaper and less stressful option

Considering all of these costs, perhaps it’s no wonder that so many retirees want to stay in their home. After Joyce’s disappointing experience with a smaller home, she moved to a larger house, which provides plenty of room to have friends over. “It’s been three years since we moved out of downsizing,” she says. “It was the best decision I ever made.”

A reverse mortgage can be the ideal alternative to downsizing. You can access up to 55% of the value of your home and you don’t have to move hours away from your family or friends – you get to stay in the home you love.

The money you receive from your reverse mortgage can not only improve your finances, but it can also help remove other reasons why you might be considering downsizing: for example, to pay for a cleaner or a gardener.

With no regular monthly mortgage payments to make, a reverse mortgage is becoming an extremely popular alternative to downsizing

Call us at 1-866-522-2447 or use our reverse mortgage calculator to find out how you can save on the stress and expense of downsizing and live retirement your way.