Reverse mortgages in Canada continue to grow in popularity, and there are a wide range of reasons why.

Retirees who have no private pension or retirement savings can struggle to have a comfortable retirement with only the Canada Pension Plan and Old Age Security for income. Others want to stay in their home as they age but need to renovate it to make it more accessible, as their mobility becomes restricted. And some retirees want to have a more enjoyable retirement than their current retirement income allows.

Many Canadian retirees are sitting on a huge asset — their home — and have little income or other assets. A reverse mortgage can be the ideal way to cash in some of their home’s equity to boost their retirement income.

In this article, we’ll look at some reverse mortgage examples to show how a reverse mortgage can help people in a variety of situations. We’ll also have reverse mortgages explained and answer some common reverse mortgage questions, such as; how does a reverse mortgage work; how much money do you get from a reverse mortgage; how do you pay back a reverse mortgage; and who owns the house with a reverse mortgage?

Reverse mortgages explained

A reverse mortgage in Canada works very similar to a conventional mortgage; money is lent to you, using your home as collateral (which means your home is used as security to guarantee that the loan will eventually be paid off).

However, unlike a conventional mortgage, you don’t have to make any monthly mortgage payments with a reverse mortgage in Canada. If you’re age 55-plus, you could borrow up to 55%* of value of your home and only pay back what you owe when you choose to move or sell.

This feature alone makes a reverse mortgage in Canada a very appealing financial option for many retirees. Retired homeowners can cash in some of their home’s equity and use the funds however they wish.

How does a reverse mortgage work – example

After your application for a reverse mortgage is accepted, you can choose to receive the money in a lump sum and/or in monthly or quarterly deposits. The funds from a reverse mortgage are tax-free.

How much money do you get from a reverse mortgage? This will depend on several factors: the value of your home, your age, and your home’s location and type. You just need to live in your home, keep it insured and in good condition, and pay property taxes.

Who owns the house on a reverse mortgage? You own it. You stay on the property title and keep all the benefits of being the homeowner. After your application for a reverse mortgage is approved, you can choose to receive the money in a lump sum and/or in monthly or quarterly deposits. The funds from a reverse mortgage are tax-free.

How much money do you get from a reverse mortgage? This will depend on several factors: the value of your home, your age (and your spouse’s, if applicable), and your home’s location and type. You just need to live in your home, keep it insured and in good condition, pay property taxes and abide by your mortgage contract.

Who owns the house on a reverse mortgage? You own it. You stay on the property title and keep all the benefits of being the homeowner.

How do you pay back a reverse mortgage? You only have to pay back what you owe when you choose to move or sell your home, or when the last borrower passes. The proceeds of the sale of your home will go towards paying off your reverse mortgage. HomeEquity Bank, provider of the CHIP Reverse Mortgage, guarantees that the amount you owe will never be more than the fair market value of your home with the No Negative Equity Guarantee**.

3 Reverse Mortgage Examples: How much can you receive?

Now that we’ve had reverse mortgages explained, let’s take a look at some reverse mortgage examples that show how much money retirees in different situations could expect to receive. We’ll also explore some examples of how a reverse mortgage can help retirees with challenging financial situations.

The figures below are for illustration purposes only and are subject to change. Interest rate and qualified amount are based on several factors and can vary by location, type of home, and the homeowners’ age. Certain assumptions are made, and these assumptions are not necessarily indicative of future market performance or interest rates. External factors are not accounted for in the calculations and may affect future projections. This information is not intended as specific financial, legal or tax advice for any individual and should not be relied on as such. HomeEquity Bank does not make any representations or warranties with respect to the illustrations.

Reverse mortgage example #1 — Nadia

Reverse mortgage example #2 — Emir and Carmela

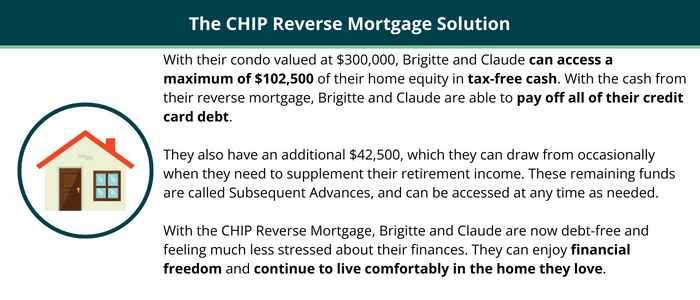

Reverse mortgage example #3 — Brigitte and Claude

Is a reverse mortgage right for you?

A reverse mortgage can be a very useful financial option for Canadian homeowners age 55-plus. As we’ve seen from these reverse mortgage examples, it can help you to:

- Retire on your terms

- Pay off high interest debt

- Reduce your financial stress

- Retrofit your home to make it more accessible

- Live a more comfortable and enjoyable retirement

- Stay in the home you love

- Help a loved one

You can find out how much tax-free cash you qualify for with a CHIP Reverse Mortgage by calling us toll-free at 1-866-522-2447 or by using our reverse mortgage calculator.

*Some conditions apply

** Customers must maintain property, property taxes, homeowners’ insurance and abide by their obligations under the mortgage contract. The guarantee excludes administrative expenses and interest that has accumulated after the due date.