Today, Canadian retirees need to adjust their retirement plans to account for the changing retirement landscape. For starters, retirement is lasting a whole lot longer. With life expectancy now almost 83, and many people living well into their 90s, retirement savings have to potentially last 30 years.

In addition to increased life expectancy, government and company pensions are being reduced or even phased out. This double-whammy of reduced pension income and increased retirement years is putting a financial strain on many Canadians.

Many people are reluctant to draw on investments early because of tax penalties and decreased earnings. Others find that borrowing options, like second mortgages, Home Equity Lines of Credit (HELOCs) or alternative lenders, are either too expensive or greatly reduce their disposable income.

A reverse mortgage is becoming an increasingly popular option for many Canadians aged 55 or over. Here, we’ll take a look at the pros, cons and common misconceptions of reverse mortgages to help you see if this financial solution is right for you.

Advantages of a reverse mortgage in Canada:

Here are some of the main advantages of a reverse mortgage.

- Access your home equity to increase cash flow. Your home has likely increased in value over the years, making it your most valuable asset. With a reverse mortgage, you can access up to 55%* of the equity in your home, tax-free, to help boost your cash flow. Plus, you don’t have to make monthly mortgage payments, which frees up additional cash.

- Stay in your home. A reverse mortgage lets you stay in the home you love and age in place – a dream shared by 93% of Canadians. You also get to benefit from future home price appreciation as your home usually grows in value overtime.

- You maintain ownership. With a reverse mortgage, you always maintain title ownership and control of your home. As long as the property taxes and insurance are in good standing and, the property remains in good condition, and you continue to live in the home, the loan will never be called in, even if the house decreases in value.

- Meet your financial needs. You can use the tax-free cash to meet any of your financial needs, including debt consolidation, medical expenses, living costs, or helping your loved ones. You may choose to receive the cash as a lump sum, or as an income solution in monthly or quarterly installments.

- Keep your investment portfolios intact longer. Tapping into your home equity through a reverse mortgage means that your registered savings accounts can continue to grow on a tax-deferred basis for your retirement years. Plus, since the cash received from a reverse mortgage is a loan, it’s not added to your taxable income and does not affect benefits such as Old Age Security (OAS) or the Guaranteed Income Supplement (GIS).

Disadvantages of a reverse mortgage in Canada:

These are some of the disadvantages of a reverse mortgage.

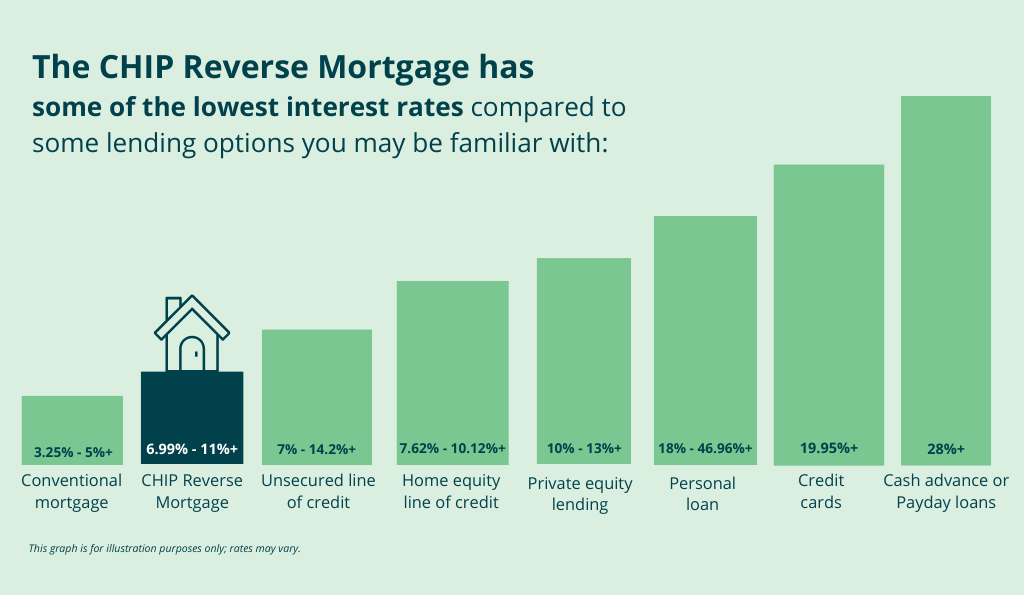

- Higher interest rates. Interest rates for a reverse mortgage are typically higher than a traditional mortgage or Home Equity Line of Credit (HELOC). The higher rates are due to the fact that you don’t have to make monthly mortgage payments. However, reverse mortgage interest rates are still not as high as an unsecured line of credit, personal loan, a second mortgage or credit card. To find out what our current rates are, click here.

- The balance of the reverse mortgage loan increases over time. This is true unless you choose to make interest payments, in which case the principal borrowed is the amount owed.

- Inheritance may be reduced. If you choose not to make interest payments and the loan balance does increase gradually over time, the remaining equity in your property – and any inheritance you may plan to leave to your children and relatives may be reduced.

- You may not be able to use your home as collateral again. Taking out a reverse mortgage means that you may not be able to borrow more money against your home in the future.

- Downsizing may be an option, but…While downsizing might work for some, it can cost thousands of dollars in realtor’s fees, land transfer tax and legal fees. Downsizing also means that you have to move out of your home. For some, the emotional and financial costs involved in leaving your home make this option less appealing.

Who is a reverse mortgage for in Canada?

-

Canadian Retirees who need extra income

Reverse mortgages are well-suited to people in need of extra cash or those looking to consolidate debt and/or reduce their monthly payments.

-

House-rich, cash-poor Canadians

This is a great way to use their home equity to boost their retirement income.

-

Retirees who are determined to stay in their home

A reverse mortgage can be a powerful financial tool. In fact, 93% of Canadians want to age at home so this is a great financial solution to help them keep their independence and stay in the home they love. Reverse mortgages are designed to help Canadians, like you, stay in their home for life.

-

Financially savvy Canadians

Those who are looking to leverage their home equity as part of their comprehensive retirement planning and financial strategy.

How to get a reverse mortgage if it’s right for you?

One pro that we forgot to mention is that the application process is simple and straightforward. Just call us at 1-866-522-2447. We will ask you a few questions and begin the process for you to help you access up to 55% of the value of your home in tax-free cash and help you live retirement your way. Still not sure? Find out which reverse mortgage product suits your need.